We invest in privately held, lower mid-market companies with strong fundamentals, untapped growth potential, and a clear path to value creation. Our core focus is on tech-enabled and information services businesses that are EBITDA positive, operate in defensible niches, and benefit from recurring revenue models, data-driven workflows, or scalable platforms.

Our team partners closely with founders and management teams, offering not just capital but senior-level advisory expertise and deep analytical support. We work to accelerate growth and

enhance long-term enterprise value through a hands-on, collaborative approach.

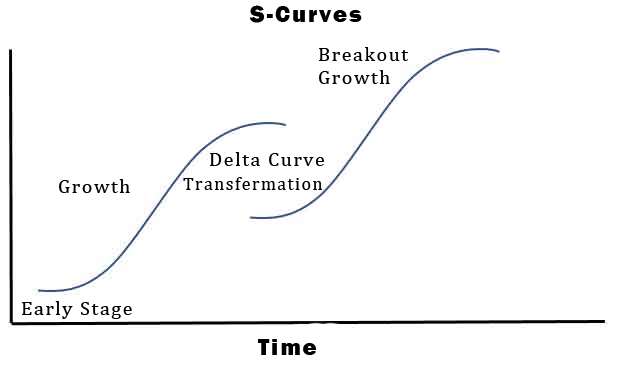

We are especially drawn to companies that have hit a growth plateau—where our strategic capital, GTM acceleration, and product scaling capabilities can create a new inflection curve. Whether through operational improvements, digital transformation, or targeted acquisitions, we reignite momentum and unlock breakout growth.

We invest in companies that have achieved financial sustainability and are primed for their next stage of growth. These businesses have crossed the inflection point of product-market fit and require strategic capital and operational expertise to scale further.

We seek businesses with proprietary technologies, data assets, or domain-specific knowledge that create competitive moats and enable unique insights. These attributes are not easily replicated and position our portfolio companies for long-term leadership.

We are not constrained by traditional capital stacks or institutional rigidity. By embracing a more flexible investment framework—including minority and control investments—we attract a diverse base of investors and unlock opportunities that others overlook.

While our primary focus is on technology and information services, we take a diversified view across sub-sectors such as SaaS, analytics, vertical software, cybersecurity, automation, and tech-enabled services. This breadth allows us to capitalize on emerging trends while managing portfolio risk.

We see ourselves as more than capital providers. We work closely with founders and management teams to accelerate growth through operational best practices, go-to-market strategies, data-driven decision making, and strategic M&A. Our value creation model is hands-on, collaborative, and tailored to each business’s unique journey.

We believe that by combining rigorous financial discipline with a vision for innovation and

scalability, we can generate superior returns for our investors while supporting the next

generation of category-defining technology companies.